This part of the world was once the economic superpower of the planet. Dynasties in China made groundbreaking discoveries, including the compass, printing, papermaking, and gunpowder. They led vast expeditions across the globe, solidifying their dominance. This was China, the Middle Kingdom. Right next door, India also played a pivotal role in global trade and culture. Together, they were at the centre of the global economic universe.

In Milton Friedman's words, quote "The social responsibility "of a business is to increase profits." That is the rule of a business. According to this model, increasing short-term gains for shareholders would benefit society. And if you look at the data, Milton Friedman sort of had a point in the United States and the west. And it led to huge prosperity in the West as the U.S. economy exploded.

Wait a minute, but what about China? Aren't we talking about China and its economy? You know, the Middle Kingdom, China. So, while the U.S. and western economies are thriving, because of this corporate free-market capitalism that was taking over the world, China was descending further and further into decline.

Instead of joining the capitalism party that the west was spreading throughout the world, China resisted, turning to a one-party-rule communist system, headed by Mao Zedong, who destroyed any chance of China's economy ever joining the prosperity happening around the world. By the 1970s, China was a place of widespread poverty. The once prosperous kingdom had reached rock bottom, but that was all about to change.

So it's the 1970s, and this is China's new leader, Deng Xiaoping.

He came into power hoping to turn around this 150 years of humiliation in China, the decline of China as a superpower. Elsewhere in the region, China's neighbors had economies that joined the global economic party that was happening in capitalism, and they were thriving.

They saw immense economic miracles and pulled millions out of poverty. Deng specifically went on a visit to Singapore early on in his term where ethnic Chinese had adopted the free market, and they were thriving. He felt inspired. The Maoist economic doctrine that had failed was over, and it was time to see if China could rebuild its economy, experimenting with some version of capitalism. But he had to do this carefully so as not to disrupt the one-party rule that China had created, so he decided to just focus on one little village, a sleepy village in southern China of just around 30,000 people, right across the border from the British-controlled Hong Kong, which, at the time, was thriving because of its hardcore capitalistic economy.

Deng Xiaoping designated this little town as, quote, a special economic zone where foreign companies could set up and invest in a very capitalistic free market. Hong Kong would sort of act as a bridge between western businesses and this little gateway into communist China. It was still socialism, but with some Chinese capitalistic characteristics. What happens next is arguably the most mind-blowing economic miracle ever to have taken place on planet Earth.

This little, sleepy village that was a special economic zone in China exploded from a little fishing village with little more than a few thousand people and some rice paddies to a massive city of over 10 million people. The average income went from $1 a day to over $30,000 a year. This starts happening all over China, and meanwhile, Milton Friedman's back in the U.S., being like,

Soon, there were a bunch of cities designated in China for special economic activity, or, basically, capitalism in a socialist country, and more and more foreign companies flocked to China for its cheap labour. It became the world's factory. China joined this trend of other Asian economies and eventually passed them up to become the second-largest economy on earth. You can see this in a graph. This year, Asia will actually pass the rest of the world in accounting for more than 50% of global GDP.

It is a massive economic transformation, and it explains why China has become so powerful.

Okay, but wait, this is a very wonderful story about capitalism and its ability to lift millions of people out of poverty, and to industrialize a country seemingly overnight, but there's another side to this coin that we need to talk about.

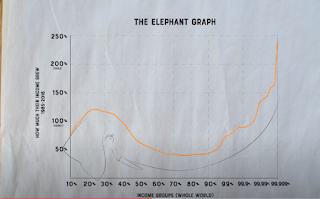

I have two graphs I wanna show you.

|

| Elephant graph |

They have an income that puts them in the 90th percentile. This axis here shows how much growth and income these people have had over the past 35 years, basically during the heyday of shareholder capitalism and the rise of China. So, you'll see how this plays out in just a second. Let's start plotting how much income growth each group saw over the past 35 years. The bottom 10% saw their incomes grow by around 75%, not bad. These are people who live in the poorest countries and who make the lowest income in the world. The 20-30% saw huge growth in their income, 125%, and moreover, the past 35 years. This is like the new middle class in China and other Asian countries. Who saw huge income growth due to globalization. They did really well under this system. But then, you start to get to the people in the 50th, 60th, 70th, and 80th percentile.

The people in China who benefited from this mass industrialization saw huge benefits, and the people here in the United States and in the West who saw jobs go overseas to China saw a way slower growth in their income. But watch what happens next when we get to the groups of people who are at the 99 percentile, basically the richest 1% in the world, and for this, I have to stretch out the graph to get us a little bit more granular. These are the people who have the highest incomes in the world.

Let's see how their income has grown over the past 35 years. You can see that their income has exploded under this system. They've seen a tripling of their incoming in the past 35 years. Now, a reminder that this is 35 years of data from every economy on earth. This shows everyone on the planet. So this gives us a view of who are the winners and the losers of this shareholder capitalism that has globalized to Asia and around the world. The top 1% of income earners saw the biggest benefits from this system.

They are the ones who disproportionately benefit from shareholder capitalism and the growth of globalization. Okay, so in my first graph.

It's the Elephant Graph. It is a very useful way to see one of the results of this version of capitalism and the growth of China. The second graph looks like this. This shows the amount of CO2 emissions by country. You've got Europe and the United States, and then, up here, you've got China, the world's largest emitter of CO2. Like the Elephant Graph, this graph combines loads of data to show us that shareholder capitalism focuses so much on short-term profits for shareholders that it leaves out any consideration for how this economic activity affects our planet and our ability to live on it. I know you've heard this message a bunch, and if you're like me, it is hard to not become sort of numb to this impending crisis that, we don't really know what it looks like, and it feels like there's nothing we can do, but we have to do everything really quickly. But let me just reiterate in my own words that it is now a certain fact that our global climate is changing in such a way that it will very likely lead to immense shifts on our earth, and our ability to live on our earth. It's already happening, it will continue to happen, and all we can do now is maybe put on the brakes a little bit.

Okay, let me just wrap this up, and give you my final thought on what this all means. I'm not showing you all these graphs because I'm just, like, a data nerd who loves to look at graphs, although I kind of is. Sorry. I'm showing you these graphs because the story of the rise of China is often a story of how capitalism has pulled tens and hundreds of millions out of poverty, and it has, and that's amazing, but these graphs give us a view of what it has also done, what this version of capitalism also incentivizes and results in. If we're going to consider the effects of this version of capitalism, we have to look at all of its effects, not just some of them. So, what's the solution? Is it socialism? No, it's not.

It is simply a new version of capitalism, a reframing of how we think about business and globalization, one that old Milton Friedman would despise, and one that more and more businesses are actually realizing we must adopt. The solution isn't to scrap capitalism altogether, but instead to expand it, to not just focus on shareholders and deliver them short-term profits as quickly and as efficiently as possible, but to also focus on other people who are affected by the business.

You can call these stakeholders. This is like the customers, and the suppliers, and the employees, and the government, and the overall economy, and the planet, and, of course, shareholders. his is called stakeholder capitalism, and it's basically just an acknowledgement that business that focuses only on profits for shareholders don't end up benefiting everyone. There are winners and losers. It's not good for a huge swathe of the population, nor for the changing climate. Oh, and by the way, this isn't some fringe liberal idea. Some of the biggest companies here in the United States like Walmart, Apple, and JPMorgan, have signed onto adopting a new model of capitalism. This is changing and in the next five to 10 years, I believe we will see a new version of how businesses interact in the economy. So you're probably wondering, listen, I clicked on a video about the rise of China, and we're ending here with stakeholder capitalism.

The rise of China is a story of capitalism, a certain version of capitalism. It's a story about how capitalism can morph and change depending on what effects we want businesses to play in our society. If we want to produce the most amount of wealth most efficiently, then the old shareholder model actually really works well for that, but if you want businesses to benefit everyone, including our children, and our grandchildren, and their ability to live on this planet, then our capitalism needs to pull in more priorities than just prophets for shareholders.

"What may be right for one stage in the development of an economy may not be right for another stage." The so-called greenhouse effect is created by carbon dioxide, a colourless, odourless gas. So, I got to dig through a lot of data for this video, and I was able to partner with the World Economic Forum, which is a think tank that I respect. They actually pioneered this idea of stakeholder capitalism decades ago, well before Apple and Walmart realized that it was a good idea. The head of the World Economic Forum just launched a book called literally "Stakeholder Capitalism."It's an in-depth look at not only the rise of Asia and China but also other major trends that help us understand the need to upgrade our capitalism.

The book is really good. It's packed with useful information and graphics. It's easy to read and to comprehend. I will put a link in the description where you can learn more. It is available for you to purchase now if you want to get a deeper look into the future of our economy. Thank you, World Economic Forum, for partnering with me on this video. The Davos Summit happened this week, and I'm really glad I could be a part of it. So, hope you're all doing well, and having a good year so far, 2021. There's a new president down the road, and it's kind of exciting. And I'll see you in the next one.